Technology stuns us daily with innovative ideas that change how people work and live. The world around us is awesome because the digital revolution gives you many ways to save time and effort. Whether it is about booking tickets, finding new places, fixing meetings, or learning new courses, anything that needs sending or receiving money through your smartphone, has become easy. More businesses need reliable fintech app development services to create complex apps that provide robust financial services.

Amidst so many tech innovations, P2P payment apps have made an impact among users, proving an efficient P2P money transfer application. Users can send and receive money with convenience and top security. As an experienced cross-platform app development company, we share with you our major inferences about P2P Payment app development.

- Know your competitor strategies before you build a P2P payment app. Big apps like PayPal and Cash App have developed users’ habits, set trends, and established top technologies to give the best peer-to-peer solutions.

- The most promising P2P payment solutions come from crypto-based P2P mobile wallets, message-based payment apps, transaction platforms, and standalone P2P mobile applications.

- The top secret to develop a strong P2P payment app is to have an agile team for prototyping and effective MVP app development.

What is a Peer-to-Peer Payment App (P2P)?

Peer-to-peer payment application is a system that works as a middleman to help anyone transfer funds from their bank account to another person’s bank account. It is mostly used for sending cash birthday gifts, splitting bills, or paying rent. P2P payment apps are gaining high popularity among the younger generation who trust sharing their financial credentials with any third-party software. Most of the P2P platforms are mobile-based like Zelle or Venmo. However, PayPal supports the desktop version for all types of transactions. The global valued amount of P2P transactions is expected to cross $11.62 trillion by 2032.

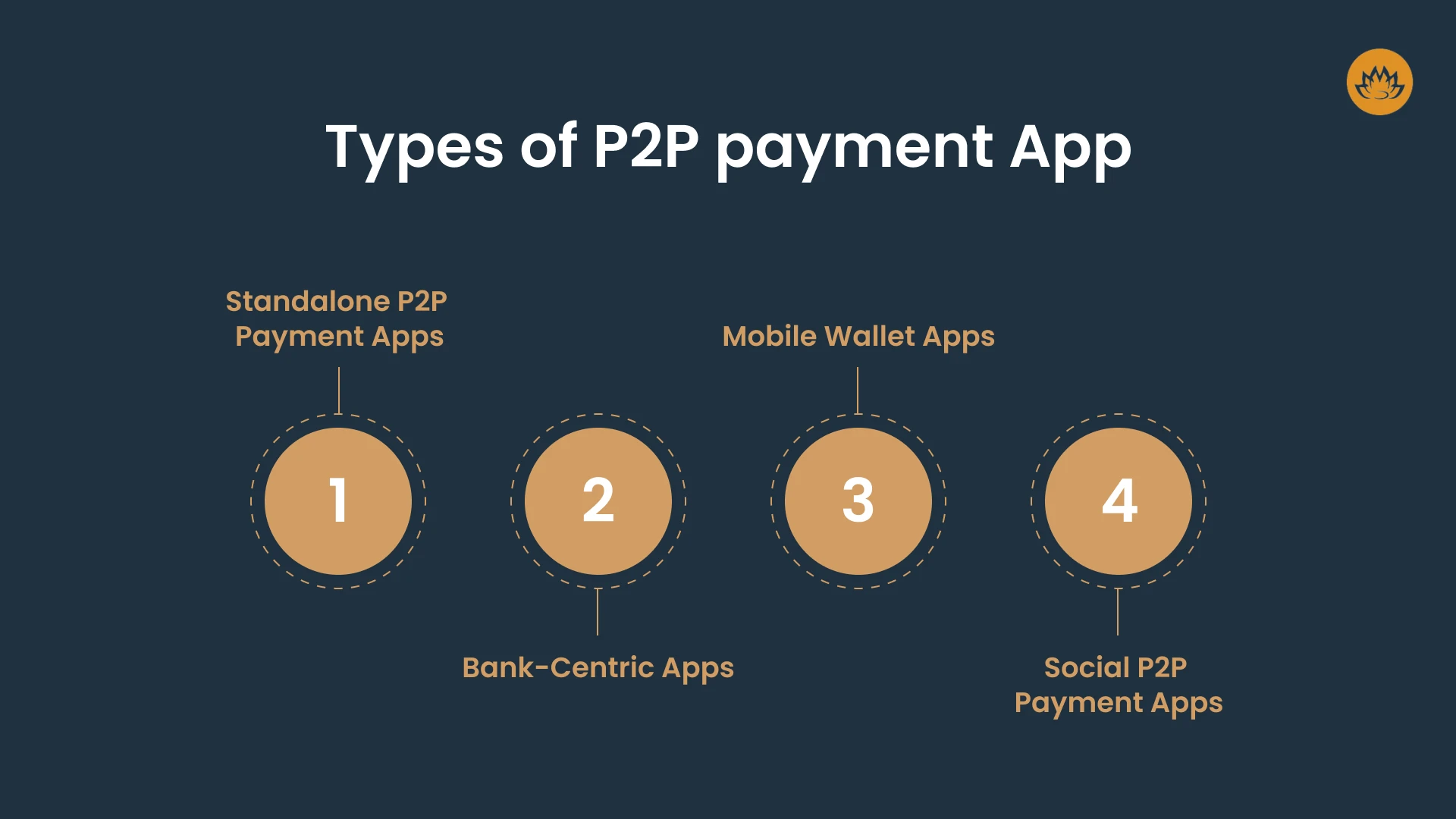

Types of P2P

Standalone P2P Payment Apps

These apps explicitly focus on payments and have an autonomous system that does not rely on other systems to manage and safeguard funds. With its topmost feature called “Digital Wallets”, users can store money with security in the app. They can effortlessly transfer funds to people they trust and can also do transactions in their bank accounts. Standalone P2P Payment apps have a seamless and user-friendly interface that helps individuals send and receive money easily. PayPal and Venmo are the top and most trustworthy financial services providers till now.

Bank-Centric Apps

Bank-centric P2P payment apps are linked with traditional banking apps and provide financial services to banks. Users can manage finances, send money, and pay bills from their existing bank accounts. They are highly secure and provide a universal banking experience. They are easy to use and access and cater to larger audiences. Examples are Zelle and Revolut

Mobile Wallet Apps

Apps like Google Pay, Apple Pay, or Samsung Pay can store user information like payment card details safely on their smartphones. Users can make contactless payments at any physical store having NFC terminals (Near field communication). Users can also do online shopping with just a single click and can win loyalty cards, boarding passes, and rewards.

Social P2P Payment Apps

Also known as social-media-centric apps, they are built for popular social networking platforms like Facebook and Snapchat. Users can pay or receive money within their social networks. Such apps utilize the benefits of social connections to provide easy-to-do transactions and to create a streamlined social payment ecosystem. Examples of such apps are Meta Pay, Snap Cash, Splitwise, etc.

How P2P Payment App Works

- Create an account and add your name, email, and phone number.

- Add a card that links to your bank account to access contactless payment methods

- Search for your friend or a relative by typing their phone number or user name.

- Choose the amount of cash you need to send and confirm the transaction

- Users will see the confirmation of the transaction along with the history.

Top examples of similar P2P Payment apps are Revolut, Cash App, and PayPal.

What are the Steps to Build a P2P Payment App

There are several steps to creating a P2P payment app. Each of them is important to make sure your app functionality is good and meets the goal.

Define Your Business Model and Competitive Strategies

Your app idea should be solid, reliable, and concrete enough to start with the building process. Find out about the performance of existing products in the market. Understand the level of user attention around the existing P2P payment apps as these apps will be your front-line competitors. At this stage, thorough market research is needed to understand features that competitors use to attract users. Also, you must understand the challenges they face to find the exact pain points of their target audience. Based on your research, discover what several nuances of your product can be, know the target users, what will be the platform for the P2P payment app release and what strategies you can design to attract your set of target audience.

Designing Intuitive UI/UX

User interface and UX design are two important aspects to consider while building your P2P payment app. Keep your layout minimalistic and user-centric. This will create seamless user experiences. UI/UX developers use a diverse set of design tools and elements to create exceptional P2P payment apps, that are visually appealing driving existing and new users to stay with your app for the long run.

To create compelling designs that can resonate with your target audience you can use the following ways:

- Identify types of users by surveying various groups and categorizing them based on their habits, choices, demographics, etc. and find similar user persona

- Create a user journey map that has various scenarios of user interaction and analyze their goals and pain points.

- Use the collected information to design an intuitive layout with visually appealing design elements that help users easily navigate your product.

Collaborating with a well-established cross-platform app development company can help you create wireframes that can capture your screen space and develop mockups with a UI kit having graphic elements.

Executing Product Development

Crafting a Minimum Viable Product (MVP) is the initial step in developing a fintech product like a P2P payment app. Integrating the most advanced and relevant front-end and back-end technologies enables user-friendly and easy access to various features. MVP app development can initially save you from heavy investments and will help you determine your app’s relevance and usefulness.

You need Android app development and iOS app development services to reach out to massive target audiences at the initial stage. You can build the first version of your MVP to show to your investors and then share it with the users. Your MVP must have the basic features, including the minimal features that make your product stand out from your competitors. They can be a user digital wallet, 2FA authentication, contact access, bank account integration, transaction history, real-time money transfer, push notifications, send and request money, fingertip security lock, chatbot, etc.

Developing an MVP will enhance your product, help you in iteratively implementing additional features, and validate your product idea. It will reduce time-to-market and will deliver value to your users. In addition, you can also integrate AI in fintech app development to provide personalized user experiences. The entire process of product development execution will amplify your P2P payment app performance and establish lasting relationships with your customers.

Implement security measurement

Implementing security protocols is crucial while you develop your P2P payment app. Your app must be protected from cyberattacks through integration of resilient data safety features and cyber security practices. You can incorporate features like fingerprint, scanners, face recognition, etc. To obtain maximum compliance, you can implement a two-way authentication feature and a robust encryption to protect sensitive user data such as personal information and transaction details.

FinTech App Legal Compliance

To build a Fintech App you need to follow PCI-DSS standards (Payment Card Industry Data Security Standard). After acquiring the said PCI-DSS certificate to ensure trust and transparency, you can use Fintech app development services to build a robust fintech P2P payment app.

Testing and QA

Launching an unfinished product can be a big failure. You would not want your users to face bug issues while using the app for the very first time. Therefore, ensure you perform a quality check. Quality assurance is a very important step in the development process of a P2P payment app. You need to ensure there is no potential data breach and must find ways to fix any future mistakes that may occur, before even launching your solution.

Product Release

Launching an MVP will help you get real feedback from the users about your product. This will be the time to improve your app and take the initiative to launch it the right way. You can add more features to fulfill the demands of your customers, improve performance, and finally create a full-functioning app. For that, you must choose the best tech stack for mobile app development, ensuring that your product is competitive and works with the latest technologies.

Support and Enhancement

After you release your product, it becomes equally important to keep a watch on its performance and maintain complete data security. For that, you may need to make data-driven decisions for product enhancement. You can also gather feedback from users and identify their pain points. This can help you grow better and improve your app by using additional features, enhancing user experiences, and updating the UI/UX elements.

Conclusion

To develop a strong P2P payment app is a challenging process. However, its benefits are far more rewarding than other types of mobile applications. By hiring experienced developers, you can understand the present challenges, introduce a robust MVP, seek reviews and feedback, and create relevant solutions for your target users. Whitelotus Corporation is a mobile app development company that develops and deploys custom financial solutions. We are experts in MVP development, effective project management, and user-oriented UI/UX designs.

Whitelotus Corporation is a leading P2P payment app development company, that delivers robust fintech solutions. You can hire developers from Whitelotus Corporation to build small and large-scale fintech applications. We know how to harness the tools and functionalities of various technologies to create the best solutions that will meet your expectations.

Author

-

Kirtan is CEO of Whitelotus Corporation, an emerging tech agency aimed to empower startups and enterprises around the world by its digital software solutions such as mobile and web applications. As a CEO, he plays key role in business development by bringing innovation through latest technical service offering, creating various strategic partnerships, and help build company's global reputation by delivering excellence to customers.

View all posts