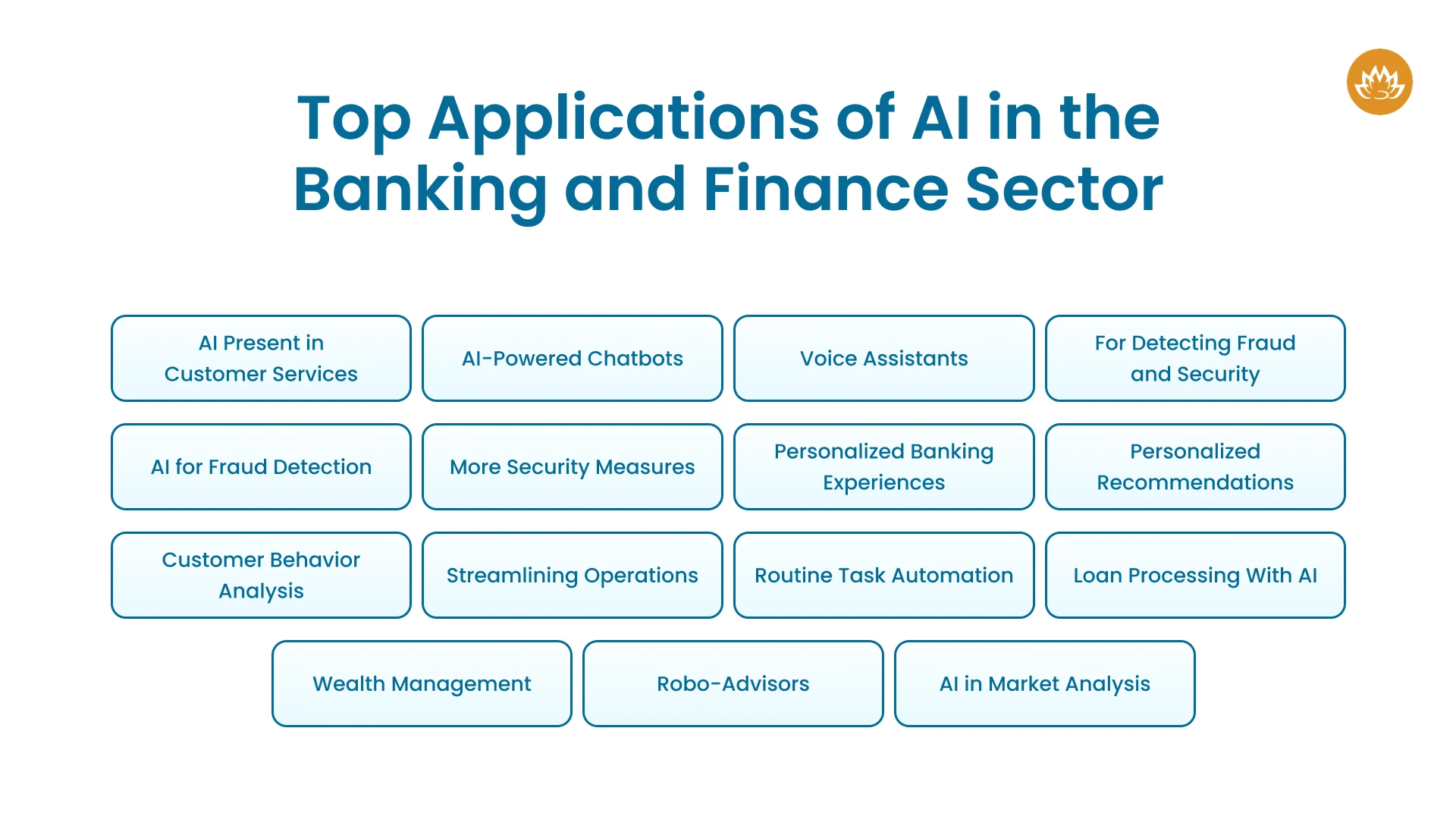

Top Applications of AI in the Banking and Finance Sector

AI Present in Customer Services

AI-Powered Chatbots

- Response times are shortened when chatbots are used.

- Evaluating client information and customizing responses provide individualized support.

- Businesses save a lot of money when they deploy chatbots.

Voice Assistants

- Customers can use voice assistants to access financial services without using their hands.

- Voice-driven banking's accessibility improves the user experience.

- They provide a more enjoyable and convenient experience.

For Detecting Fraud and Security

AI for Fraud Detection

- Banks can quickly identify and address fraudulent activity thanks to real-time surveillance.

- By preventing the incorrect flagging of genuine transactions, AI lowers false positives.

- Fintech's use of AI dramatically improves security and secures banking.

More Security Measures

- The application of AI in biometric authentication improves security by making it impossible for unauthorized users to access accounts.

- Anomaly detection further improves security by spotting and fixing possible problems before they can do severe damage.

- Together, these steps lower the possibility of breaches and give institutions and consumers a safer financial environment.

Personalized Banking Experiences

Personalized Recommendations

- By delivering specialized product offerings, banks may significantly increase client satisfaction.

- Clients receive answers and guidance tailored to their particular financial circumstances.

- In addition to meeting customers' urgent requirements, this customized strategy fosters enduring loyalty and trust.

Customer Behavior Analysis

- Banks can interact with clients more successfully if they can anticipate their demands.

- Customers feel appreciated and understood due to this proactive interaction, which increases customer loyalty.

- A deeper bond between the bank and its customers and higher retention rates result from improved customer loyalty.

Streamlining Operations

Routine Task Automation

AI in banking and finance automates regular chores and back-office procedures typically completed by people. Data entry, transaction processing, compliance verification, and report creation are all included in this.

- Increased operational efficiency results from automating repetitive operations.

- As a result, banks save a lot of money because they don't need as many employees.

- Automation guarantees greater process accuracy and reduces the possibility of human error.

- Human workers can concentrate on more complex tasks as a result of this operational simplification.

Loan Processing With AI

Artificial intelligence is revolutionizing the loan processing industry by evaluating creditworthiness and expediting loan approvals. AI algorithms analyze large volumes of data from many sources, such as social media activity, transaction histories, job records, and credit scores.

- Faster loan approvals result from the application of AI in loan processing.

- This speeds up the decision-making process and enables institutions to respond more quickly. With AI-driven credit evaluations, credit evaluations are more accurate.

- In addition to improving the loan approval process's equity and openness, this aids in determining whether applicants are creditworthy.

Wealth Management

Robo-Advisors

- Investment management is now more accessible thanks to these platforms' generally cheaper fees than human advisors.

- By using data-driven decision-making, robo-advisors reduce emotional biases and increase the consistency and dependability of investing methods.

- This results in better financial results for clients and optimized portfolio performance.

AI in Market Analysis

- AI-driven market analysis improves investment insights by delivering precise, timely, and thorough information.

- As a result, better and more informed decisions are made, and market possibilities can be swiftly taken advantage of.

- By spotting possible dangers and offering risk-reduction techniques, artificial intelligence (AI) in banking assists in managing investment risks.

- A data-driven approach to investing is ensured by applying AI in market analysis, which can enhance portfolio performance and lessen exposure to market volatility.

Challenges in AI Implementation in the Banking and Finance Industry

Ethical Issues

- Fairness and preserving client trust are two benefits of transparency in AI decision-making processes.

- Regulative agencies are increasingly scrutinizing the use of AI in financial services. To guarantee compliance, banks must manage complicated rules.

Data Privacy and Security

- Strong cybersecurity defenses guard against illegal access and data breaches.

- Banks must abide by data protection laws like the CCPA and GDPR, which guarantee that AI systems are built with privacy by default.

Legacy System Integration

- Updating IT infrastructure to accommodate AI ambitions can be expensive and time-consuming.

- Banks must create plans for smooth integration, which could involve investing in scalable technology, gradually implementing changes, and building strong API frameworks.

Future of AI in Banking

More Effective Personalization

Conversational Banking

Augmented Analytics

AI-based Decision Making

Cybersecurity Measures

Blockchain Integration

Conclusion

Author

Kirtan is CEO of Whitelotus Corporation, an emerging tech agency aimed to empower startups and enterprises around the world by its digital software solutions such as mobile and web applications. As a CEO, he plays key role in business development by bringing innovation through latest technical service offering, creating various strategic partnerships, and help build company's global reputation by delivering excellence to customers.

View all posts