Artificial Intelligence (AI) has gone from being a trendy term to the foundation of innovation in a matter of years, and in 2025, this change is most evident in the banking and financial services sector. AI is not only improving back-end operations, but it is also altering how people interact with banks, make financial decisions, and protect their financial future.

One of the most significant drivers of this transformation is AI in mobile app development. There are now some of the smartest mobile banking apps that provide responsive financial services, which are secure and personalized. They also provide real-time fraud alerts driven by AI.

Let’s explore the new, practical ways AI is transforming banking in 2025—and what it implies for both clients and institutions—in this post. At Whitelotus Corporation, we’ve been closely observing and contributing to this change.

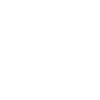

Top Areas AI is Redefining Banking and Financial Services

Artificial intelligence adoption makes sense from a market perspective, but how does this relate to financial services innovation?

Let’s consider this in terms of “capability buckets,” where AI is revolutionizing a traditional method for a crucial banking and finance function.

AI-Powered Customer Service Beyond Chatbots

Everyone has encountered annoying chatbots that seem to repeat themselves endlessly. By 2025, however, things have altered. Virtual assistants powered by AI can now have meaningful, human-like conversations. Companies now hire dedicated developers to develop AI-powered chatbots that can assist their customers in real-time and guide them through their queries.

These intelligent systems can:

- Recognize intent and context in addition to keywords.

- Estimate a user's needs by looking at their previous actions.

- Smoothly escalate problems to human agents when needed.

For instance, if a client checks their account at unusual times and then contacts support unexpectedly, the system may proactively assist in anticipation of a lost card or suspicious activity. Previously impossible, this type of smart service is now commonplace thanks to artificial intelligence.

Fraud Detection: Making Proactive Actions

These days, fraud involves more than just credit card details that have been stolen. Cybercriminals employ advanced strategies in 2025, frequently fueled by AI. Banks have had to give a similar response.

- AI is used in modern fraud detection to:

- Identify odd trends in real time

- Mark transactions that appear suspicious across several data points.

- Continue to learn from emerging risks.

These days, systems prevent fraud before it starts, without interfering with normal transactions, instead of blocking an account after it has already occurred. That’s a massive win for both banks and customers.

Hyper-Personalized Banking Services

Because of AI, personalization is now expected rather than just a nice-to-have. By 2025, banks will customize everything from product offerings to financial advice according to the objectives, habits, and stage of life of each client.

Suppose a 30-year-old client began looking at investment choices after receiving a pay increase recently. The AI engine of the bank may recommend:

- A mutual fund that is easy for beginners to use

- A brief film that explains SIPs

- A customized savings strategy based on monthly expenditure patterns

Even though it’s entirely automated, it feels like personalized guidance. It increases engagement and fosters trust, both of which are vital in the current competitive environment.

AI and Loan Approvals

In the past, obtaining a loan required days of waiting and mountains of documentation, particularly if your credit score wasn’t flawless. However, AI is altering that.

These days, banks employ AI models to evaluate creditworthiness by looking at:

- History of employment

- Spending patterns

- Payment of utility bills

- Social media usage trends (in certain areas)

With such approach, it is possible to reduce prejudice and provide equal opportunities for those with limited credit history. Additionally, approval happens significantly more quickly, often in a matter of minutes. This change is especially crucial in neglected areas where conventional banking methods are insufficient.

AI-Powered Wealth Management

Due to AI, everyone may now access investing advice that was previously only available to the wealthy. Financial institutions that provide various investment consultancy and services partner with a mobile app development company to design wealth management apps powered by AI and ML technologies.

Robo-advisors in 2025 are:

- More advanced, including portfolio rebalancing in real time

- Emotionally intelligent, assisting users in avoiding panic selling when the market declines

- Simple to use, included in standard banking applications

With a few taps, anyone who wishes to invest $500 or $50,000 can receive individualized, affordable advice. It’s making it easier than ever to acquire money.

Real-Time Risk Management

Every day, banks must manage risks related to the market, credit, and operations. AI has increased this field’s speed and level of insight.

Banks can now do the following instead of waiting for quarterly reports:

- Real-time monitoring of international financial markets

- Instantaneously simulate stress-test scenarios

- Make future risk predictions using historical data.

Responding more quickly guarantees compliance, helps avoid losses, and provides decision-makers with a better view of the future.

AI in Regulatory Compliance

Regulations governing financial firms are becoming more complex. Ignoring a step can result in severe penalties or harm to one’s reputation. Fortunately, AI is also assisting in this area.

By 2025, banks will employ AI to:

- Check transactions and communications automatically for compliance problems.

- Produce audit reports more quickly.

- Stay abreast of how laws vary by region.

This makes compliance more effective and less stressful by lessening the strain on human teams and lowering the possibility of mistakes.

Voice and Biometric Banking

Slowly but surely, changing passwords is becoming obsolete. Secure banking now frequently uses biometrics (such as fingerprint or face scans) and AI-powered voice recognition.

By 2025:

- Consumers can ask their smart speaker to pay bills or check balances.

- Instant access to ATMs is made possible by facial recognition; no card is needed.

- Real-time fraud attempt detection is achieved through the use of biometric patterns.

This combination of ease and security is just what today’s tech-savvy consumers demand.

AI and Blockchain Financial Transparency

Blockchain guarantees security and transparency, but AI interprets the massive volumes of data it generates.

Banks will merge the two in 2025 to:

- Find irregularities in transactions on the blockchain

- Simplify the execution of smart contracts

- Real-time reporting can enhance auditing procedures.

This combination lowers friction and boosts trust in a variety of areas, including trade finance and international payments.

Financial Inclusion

The ability of AI to enable those who were left behind access to financial services is arguably its most potent effect.

People in underserved or distant locations can now do the following with just a mobile phone:

- Open bank accounts using document verification powered by AI

- Apply for microloans using behavioral information rather than official credit history.

- Use conversational AI to learn the fundamentals of finance in your own tongue.

- Millions are being brought into the formal economy by this quiet revolution.

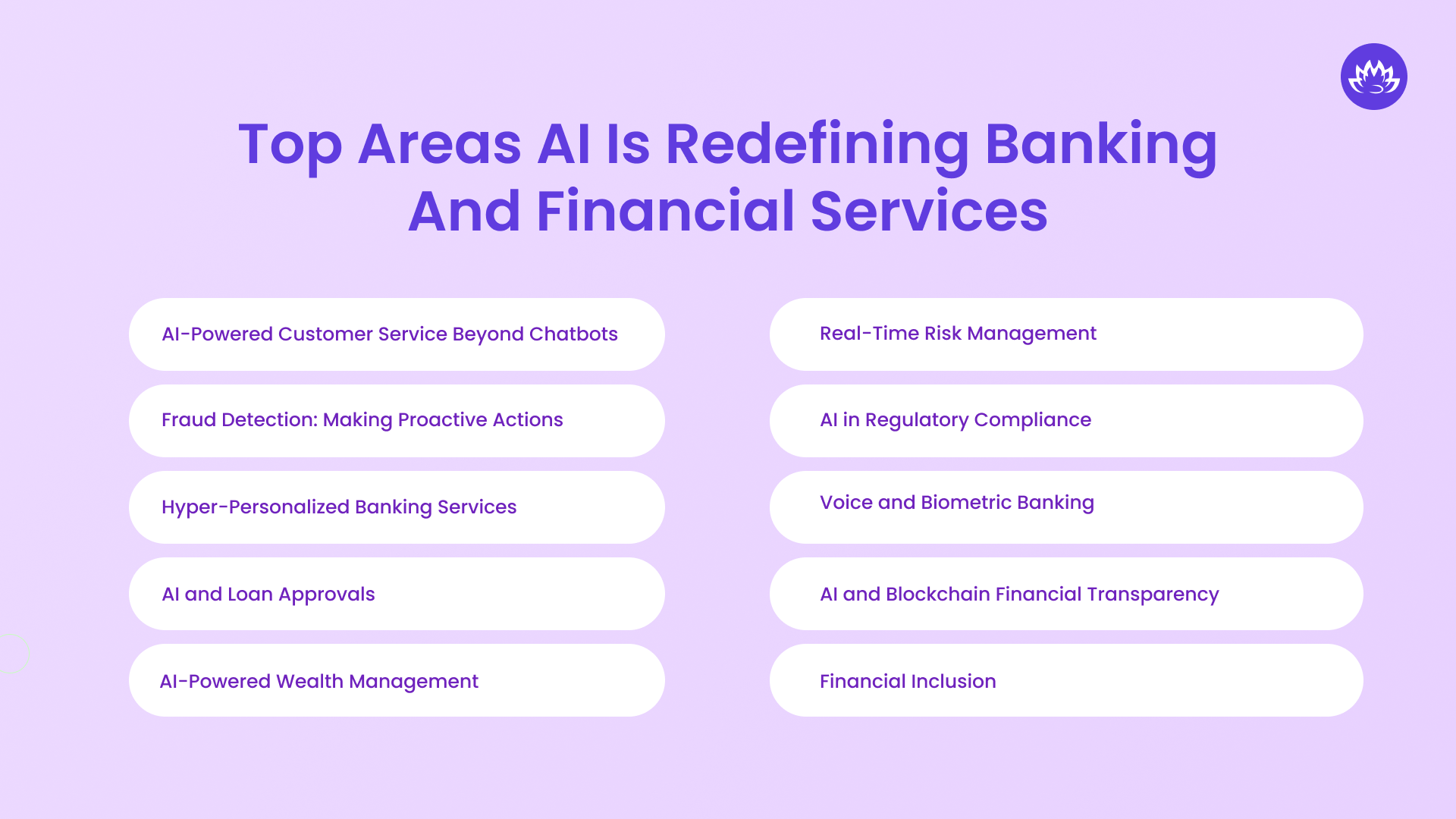

Benefits of AI Implementation in Banking and Finance

In the upcoming year, industries are under pressure to embrace artificial intelligence, but what are the advantages?

We discussed market forces in general terms above; the following list is tailored to the financial services sector:

More Accuracy in Decision-Making

AI-powered automation lessens the need for human inspection, which lowers the possibility of mistakes. Consistent judgments are produced by making decisions based on vast amounts of facts rather than prejudice or intuition.

Cost Savings For Personal Reduction

Staffing can now focus on refining models and procedures by reducing manual reviews. According to estimates, financial firms can cut hiring by one out of every five by properly integrating AI technology.

More Cybersecurity

It’s a constant struggle for banks and fintechs to stay ahead of emerging threats from unscrupulous actors. To detect and stop fraudsters using sophisticated attacks, data can be continuously fed into AI-powered models (e.g., a mixed threat of deepfakes, malware, smishing, and phishing).

Higher Scalability

Businesses require solutions that can grow rapidly without experiencing performance degradation, particularly those managing high user and/or transaction volumes. Premium capacity management is made possible by artificial intelligence, which can handle heavier workloads with little additional expense.

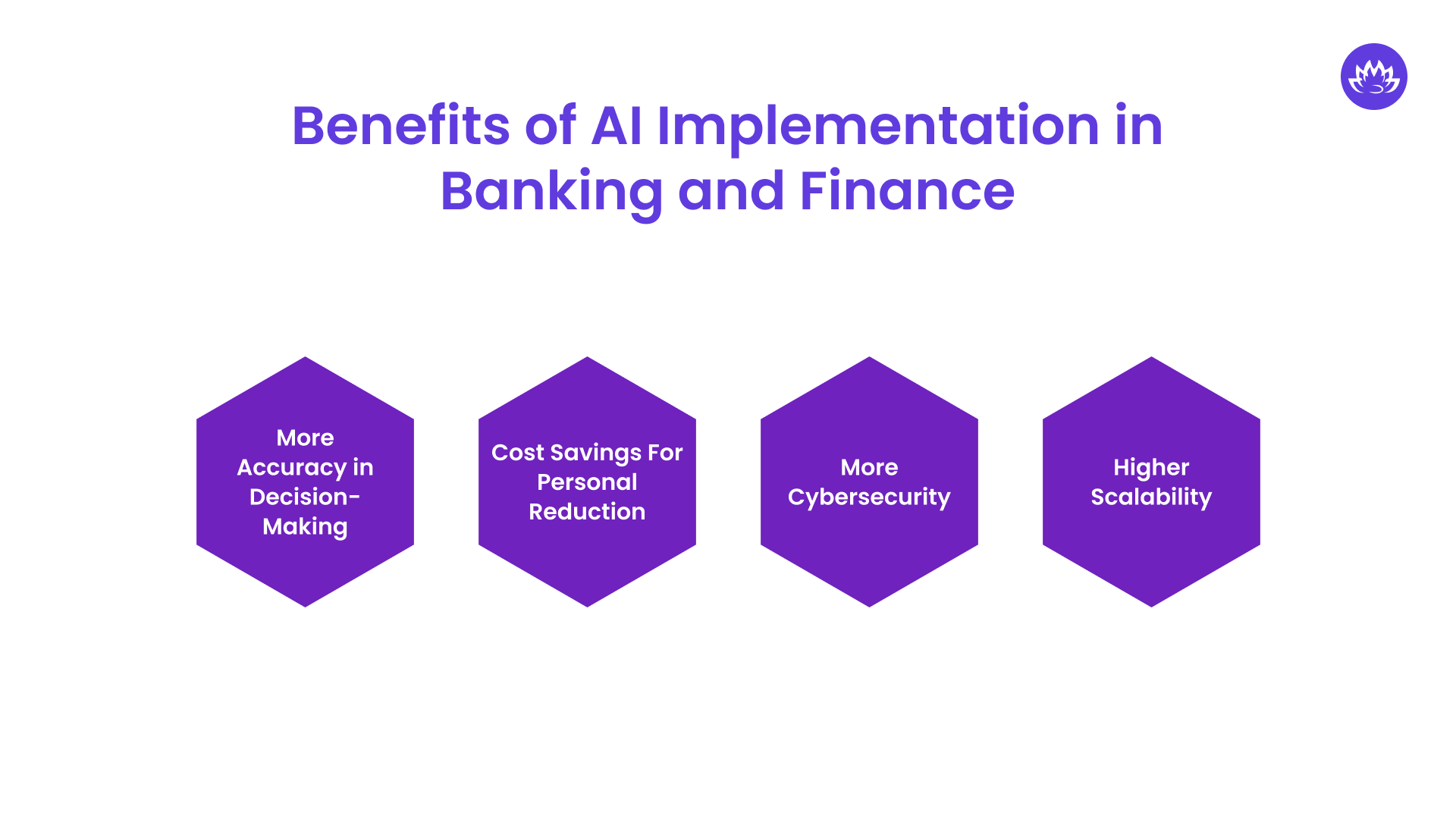

Challenges in Choosing AI for Banking and Financial Services

The advantages and applications of artificial intelligence are evident in various technology-related businesses.

When it comes to correctly using AI, financial institutions and fintechs in the banking and finance sector face several obstacles:

Higher Concerns With Security and Data Privacy

All enterprises that serve individuals and corporations have a significant obligation to prevent unauthorized access and data breaches.

Businesses must handle sensitive accounts, transactions, and financial data; otherwise, they risk violating data protection regulations, which vary depending on the jurisdiction and industry.

AI’s ability to handle massive data quantities raises this issue to a completely new level.

Lack of Ethical and Fair Consideration

AI systems are based on human-designed models and algorithms, which inherently contain bias.

Fintechs and financial institutions run the risk of unfairly judging customers if they are unaware of the inputs used to create the models.

This is important for lending programs where AI is used to automate underwriting procedures.

Regulatory violations result from unfair consideration, activities that are inadvertently misleading, and gaps in appropriate disclosures to users.

High Staffing Costs to Hire AI Experts

A global issue is the high demand and limited availability of skilled AI talent.

This fact raises the cost of acquiring and compensating AI specialists who possess the knowledge and expertise needed to deploy best-in-class technologies.

Financial institutions outsource this need to talent development and resource staffing services, as they have a wider technology gap.

Complicated Integrations

Working with legacy IT systems has historically been challenging for the banking sector due to native technology stacks that were developed before the 1990s.

Over the past 30 years, modern technology has been haphazardly integrated into this infrastructure, rather than being entirely revamped.

This makes an AI upgrade and/or integration (for a bank) far more costly than in other sectors.

More Need for Regulators

Regulatory authorities are expected to release new regulations; however, it is unclear what these will entail or when they will be announced.

The ability to adapt an existing AI integration to the most recent regulations (or modifications) to avoid fines is an issue for many industries.

Looking Beyond 2025

The banking industry’s AI journey is far from finished. Looking past 2025, we can anticipate:

- Emotionally intelligent AI advisors who assist users in making wiser financial decisions

- Banking experiences using augmented reality to improve consumer engagement

- Completely self-sufficient banks that require little human involvement

These concepts may seem futuristic, but voice-activated banking and same-day loan approvals were also popular only a few years ago.

Closing Thoughts

AI is a partner in advancement for the banking industry, not merely a tool. By 2025, it will assist organizations in becoming more customer-focused, quicker, smarter, and safer than before.

Our opinion: The future of finance is intelligent rather than merely computerized. Financial institutions of all sizes can comfortably take this leap due to our work in automation, advisory services, and AI development.

The time is here for financial service providers who want to use AI to modernize. Together, let’s create more intelligent systems, foster solid interpersonal bonds, and work towards a more inclusive economic future. Contact us to know more about our services.

Author

Sunil is a result-orientated Chief Technology Officer with over a decade of deep technical experience delivering solutions to startups, entrepreneurs, and enterprises across the globe. Have led large-scale projects in mobile and web applications using technologies such as React Native, Flutter, Laravel, MEAN and MERN stack development.

View all posts